#59: Globally Distributed Workforces, Increasing Polarization, Permanent Inflation - How Will You Be Ready For 2022

For this week's episode, we're taking a step back to address the three most pressing topics for 2022: A Globally Distributed Workforce, Increasing Polarization, and Permanent Inflation

A Hint Of 2022

This week we’re stepping back to take a macro view of 3 important trends we’ll need to solve in 2022.

Increasing Polarization

Globally distributed workforces

Inflation, some experts say CPI is ~9% right now

As you’ll learn in the 👆 pod, 2022 will be the year of choice. Choice in where you work, what you work on, and most important…who you work with.

Important Updates:

What’s our take for each update? Enjoy on Apple Podcasts or below!

🤔 According to James Thorne of PitchBook -“If globalization made the world flat, the coronavirus made it distributed. Tomorrow's companies are everywhere and nowhere. The way we used to think about geography, about building networks and ecosystems, is now irrelevant. A company is based wherever its CEO lives; employees decide where they want to pay income tax.”

🇨🇳 Will Chinese tech overtake the US within the next decade? Harvard says so.

🚀 Even VC’s go remote according to law firm Gunderson Dettmer…

~60% of venture capital firms plan to keep a hybrid work model

just 6% are mandating a return to full-time work in the office

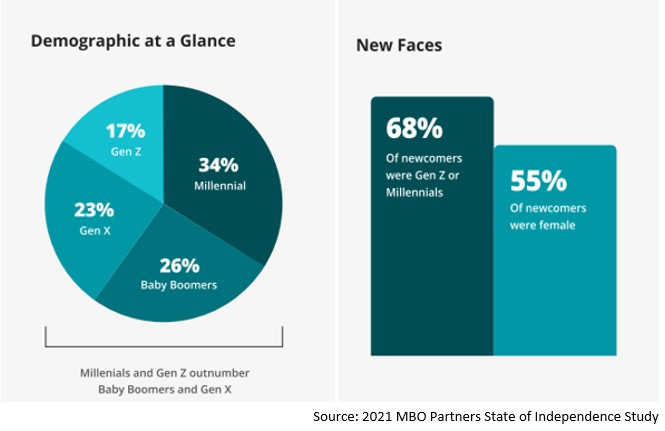

👀 Gen Z is driving the shift to independent freelance work according to Steve King.

Braintrust, freelance platform that brands itself a ‘web 3 job board’ raises $100 million through it’s own tokens.

Superside, the closest thing to Uber for freelance design services, raises $30 million.

💡 Polarization Deep Dive

My quick takeaway from Morgan Housel’s incredible article:

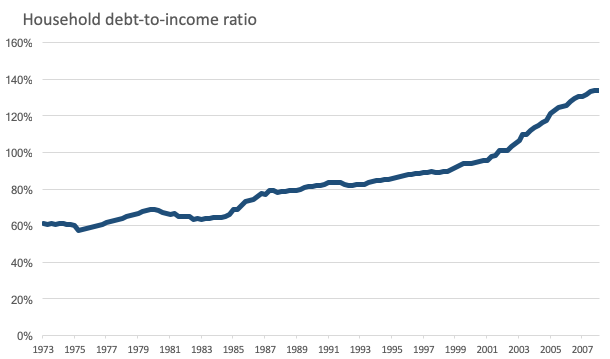

Post WWII we became a consumption society (house, car, appliances).

This worked well when income grew proportionately for everyone, and by material means we all had a similar lifestyle (there also wasn’t social media to amplify the differences).

Things started cracking once the wage gap grew, middle class incomes decoupled from productivity, then we gutted the middle class by outsourcing manufacturing to developing nations.

The problem: While everyone’s income stopped growing proportionately, our expectations maintained the same, and we supplemented our expectations with debt. Meaning we all need an iPhone (for TikTok), we all need a car, nice shoes, a college experience, etc. But instead of maintaining this lifestyle and financial security, we kept the lifestyle, traded financial security for debt, and now sit in a place where the majority of American’s are financially insecure.

*This was my interpretation. Read Morgan’s full article to make your own opinion. Then check out the pod to hear our full interpretation.

Want to be featured on The Human Cloud Podcast?

We’re booking for December. If you’re freelancing, hiring freelancers, or tapping into technology to ethically shape the Future of Work we want to talk with you!

Don’t worry if you don’t have a personal brand or following. We actually prefer that since you’re probably busy driving change :)